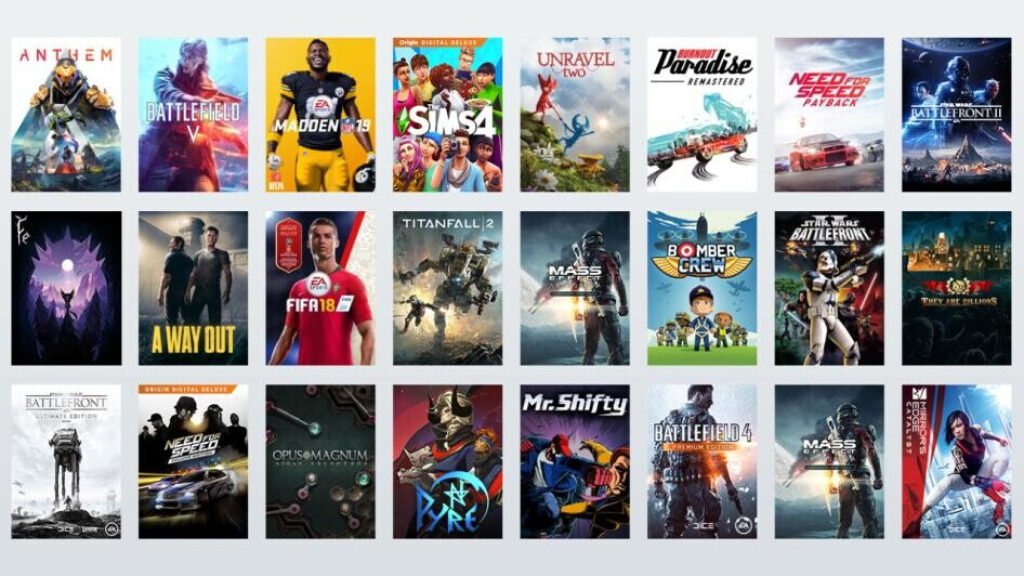

Electronic Arts, the publisher behind global gaming franchises such as FIFA, Madden NFL, Battlefield, and The Sims, is reportedly in discussions for a major buyout. A report from The Wall Street Journal states that a consortium of investors, including Silver Lake and Saudi Arabia’s Public Investment Fund (PIF), is preparing a leveraged buyout worth approximately $50 billion.

The Saudi PIF already holds a 9.4% stake in EA, making it one of the company’s largest external investors. If this buyout proceeds, it would mark one of the largest acquisitions ever seen in the video game industry, potentially reshaping the future of the publisher and its operations.

The report surfaces during a difficult period for EA. In the last two years, the company has closed multiple studios and carried out layoffs that affected hundreds of employees across several divisions. The recent release of Skate on PC also received mixed reviews from the gaming community, reflecting challenges in both critical reception and audience engagement.

Moving from a publicly traded company to a privately held one could significantly change EA’s operating environment. Without the constant pressure of quarterly earnings reports and investor expectations, the company might have greater freedom to focus on long-term planning, product development, and restructuring. This shift could also allow EA to adjust its business strategies more quickly in response to market conditions.

This is not the first time speculation around EA’s potential sale has surfaced. Previous acquisition rumors were addressed directly by CEO Andrew Wilson, who dismissed them while emphasizing EA’s financial strength. However, the current reports involve credible investment firms and suggest discussions have advanced further than in past cases. Industry sources indicate that an official announcement could be made within the next two weeks, though no final decision has been confirmed.

The potential deal follows a broader trend of consolidation in the gaming sector. Large investment groups and international corporations have been seeking acquisitions to strengthen their presence in entertainment. Ubisoft, for example, has been the subject of rumors regarding possible investment from Tencent. A successful acquisition of EA would reinforce this trend and highlight the growing role of global funds in shaping the future of interactive entertainment.

For now, EA has not issued any formal statement regarding the reported negotiations. Until further confirmation is provided, the company continues to operate under its existing leadership. Given EA’s position as one of the most influential publishers in the gaming market, the outcome of these talks will be closely followed by both industry professionals and players worldwide.

Sources: The Wall Street Journal, Game Developer